Il futuro dell'esecutivo e della legislatura dopo le elezioni Regionali e il referendum costituzionale negli scenari nel report di ottobre della School of Government della Luiss

Il report della School of Government della Luiss vuole illustrare la mappa della politica italiana a un pubblico internazionale. Al centro del documento gli scenari successivi alle elezioni Regionali e al referendum costituzionale sul taglio dei parlamentari

Italian politics has always been an arcane subject. A handful of specialists and enthusiasts love to talk of its Machiavellian intricacies for hours on end, but most people, especially north of the Alps, not only do not understand it, butsee no reason why they should bother to understand it. Today there are at least three reasons why they should. First, in Italy the crisis of the political establishment that is now evident in many advanced democracies began a quarter century ago. This means that the country is further down the road of the democratic malaise – it is a laboratory and a bellwether. Second, Italy is the first country from within the historical core of the European community to be governed by anti-establishment parties. Third, its politics represent the greatest threat to the stability, or possibly even the existence, of the common European currency. Founded in 2010 in a University that has a very strong international vocation, the Luiss School ofGovernment aimsto facilitate the connection between Italy and the world outside of it. It aims to prepare the future Italian public elite for the complexities of an ever more integrated planet, and to provide first-class education to non-Italian studentsin Italy’scapitalcity. SoG professors have often helped non-Italian journalists and newspaper readers understand Italian politics. Thus, itseems only naturaltome thatthe Luiss SoGshould offer a monthly report on Italy that provides an interpretation of the country’s recent political events, and makes an educated guess about what happens next.

Giovanni Orsina Director, Luiss School of Government

Politics

Regional elections. The regional elections ended as a tie between the centre-right and centre-left. The right-wing coalition held on to the governorships of Veneto and Liguria and it won Le Marche, a traditional left stronghold; while the left confirmed the governorships of Puglia, Campania and Tuscany.

In the last weeks before the vote, it seemed probable that the right-wing parties would win in Puglia, but in the end the incumbent governor Michele Emiliano obtained a large victory. Even Tuscany, a traditional stronghold of the left-wing parties, appeared on the brink. But the PD proved to be more resistant than expected in some territories. On the basis of the polls, the expectations for the right-wing coalition led by Salvini and Meloni were very high for these regional elections, but the opposition was able to gain only one region, Le Marche.

The result might be considered as disappointing for the right, and partly it is. The League and the Brothers of Italy failed to win in Puglia, where victory was deemed likely by Meloni and Salvini, and in Tuscany, where they attempted a blitz. However, the right-wing now dominates the entire North and it governs fifteen regions out of twenty. Concerning the balance of power within the coalition, Meloni is gaining ground with rising consensus in every region. Salvini, in coming months, will have to face the competing leadership of Luca Zaia, who was re-elected with 76% of the vote as Veneto’s governor. But it seems implausible that a public argument within the League will unfold in the next few months. It is more likely that figures such as Zaia and Meloni will influence the League’s agenda in the short run. Overall, the latest polls show that the centre-right coalition would still win an early election under any electoral law.

The secretary of the PD Nicola Zingaretti was successful in defending the governorships of Tuscany and Puglia. A defeat in these regions would have been a disaster for the PD, but with a strong candidate such as Emiliano in Puglia and with a resilient organisation in Tuscany, Zingaretti passed the test.

The worst result in the regional elections was obtained by the Five Star Movement. The party got less than 15% in every region, with very low percentages in the north. Also in Campania, a stronghold of the Five Star Movement in 2013 and 2018, it obtained only 11%. If we look at electoral results and more recent polls, the Five Star Movement is now the fourth party in the Italian political arena. The problem is that, in the current Parliament, it is by far the largest party. This misalignment between the territories (local and regional governments) and Parliament could be very costly for the Five Star Movement. It seems likely that in the next few months a competition for leadership of the party will start. The current holder of that position, Senator Vito Crimi, will be under pressure from the different factions in the party. The most charismatic members of the party such as Luigi Di Maio, Alessandro Di Battista and Roberto Fico will soon struggle to control the Movement. This time it would be difficult for the founders Grillo and Casaleggio to manage (and to tame) the conflict. The collapse in consensus will increase the frictions among the different factions.

At regional level, within a majoritarian and presidential system, the alliance between the Five Star Movement and PD is not working. Indeed, the two governing partners were allied in Liguria, where they lost heavily against the right-wing candidate and they were competing against each other in Puglia, where the PD nevertheless won. Is the alliance an idea to be abandoned at national level? It is very likely that after years spent governing together, a form of cooperation might resist for the next general election. It will depend on the electoral law, but the weakness of the Five Star Movement leaves this option still open today. In any case, we cannot exclude a structural alliance in the future at national level.

Referendum. In parallel with the regional elections, a national constitutional referendum was held to decide on reducing parliamentary seats. Despite changing positions related to political convenience over the last year, nearly all the parties were formally in favour of the reform (i.e. to vote YES in the polls). But except for the Five Star Movement, none of the party leaders campaigned for the referendum. The “YES” vote won with 70%. The reform was a flagship proposal of the Five Star Movement. It was a clear result, but not a landslide. Indeed, a significant part of the political class, except for the Five Star Movement, went against their party line and campaigned for “NO”. 30% of voters opposed the anti-political and cutting-cost rhetoric. The referendum showed a fracture within every party of the left and right: a minority of voters (according to data the most urbanized, educated and affluent segment of each party) rejects anti-political sentiments; while for a majority being anti-political still has electoral appeal. Distrust towards professional politicians still cuts horizontally across the whole Italian electorate.

leggi anche

Conte al Consiglio Europeo: "Recovery Fund priorità, evitare ritardi"

Scenario

A stronger legislature. The combination of the approval of the constitutional reform and the results of the regional elections makes the legislature more stable. Indeed, the chances for most MPs of being re-elected have fallen, due to the reduction in parliamentary seats by the time of the next legislature. This is reducing the incentives for parliamentarians of all parties to return to the polls.

The victories in Tuscany and Puglia, thus avoiding a collapse in electoral consensus, are helping the majority to avoid a shake-up. These comforting results will reduce factionalism within the centre-left coalition and provide stability to the PD Secretary.

The Five Star Movement is now in trouble and the crisis should reduce the temptation for it to break with its government allies. The same is true for Renzi, who now has to choose between persisting in building an independent centre party or find room in the bed of the left-wing alliance. The fact is Renzi is now weaker (locally Italia Viva is everywhere below 7% and at national level is polling around 2%) and it would be difficult for him to make credible threats to PM Conte in order to obtain some concessions on the government agenda. For him, torpedoing the legislature and triggering an early vote would probably mean disappearing at political level.

On the other side, the opposition seems lifeless. At the moment, the centre-right coalition is not able to apply enough pressure to produce a change in the majority or to attempt a coup in Parliament on a confidence vote. The alliance missed its shot at the regional elections and the two main parties, the League and Brothers of Italy, are now closer in terms of support and they are competing with each other. Moreover, the reduction in the parliamentary seats is affecting the entire political class. Berlusconi’s Forza Italia for example, now polling around 5-6%, would gain nothing from a snap election. Indeed, most of its MPs would not be re-elected in the new Parliament. The party has already shown in previous months the temptation to help Conte in Parliament on the implementation of European policies (e.g. the ESM programme), substituting the Five Star Movement rebels. Despite the centre-right polling as the biggest coalition in the country and governing fifteen regions out of twenty, for now it can only wait for an external shock or the natural end of the legislature to attempt to take power.

A stronger government? If the legislature is safer, it is doubtful the government is stronger, particularly in carrying out reforms. Indeed, all the previous problems are still there. The majority is fragmented and it struggles to organise the governmental machine to undertake the structural reforms demanded by Brussels. Moreover, the executive is pulling together hundreds of proposals to exploit the loans and grants of the Recovery Fund, but the priorities are still unclear and there is a lack of coordination. In pure political terms, if the results of the regional elections are positive for the PD, they are a disaster for the Five Star Movement. In fact in the main party of the coalition, a civil war has been ignited by the further negative results at electoral level. The different factions of the party are struggling to control what remains of the Five Star Movement’s political capital and the war will go on for months. This factionalism will probably imply a harsher approach when distributive policies are discussed by Conte and his ministers. On the other hand, Renzi suffered a setback at the regional elections. However, despite lacking electoral support, Italia Viva is still crucial in Parliament for the political survival of this government. We cannot exclude Renzi raising his political voice to highlight his differences with the PD and to recover his potential consensus. Such a scenario implies continuous arm-wrestling among the parties.

Then, with the approval of the constitutional reform, Conte lost an important political option to tame the governing coalition: “back me or snap elections”. In a divided parliament, with the risk of a split within the Five Star Movement, the post of the Prime Minister is not secure. Indeed, now there is more space for political manoeuvring and to attempt a parliamentary coup against the prime minister. Mobility within and among parties will increase. Some MPs, particularly of the Five Star Movement, might move to form their own grouping, looking for a new opportunity to be re-elected. Other parties, such as Forza Italia, might be tempted to participate in a new government. Other leaders, such as Renzi and Salvini, might try disruptive action against Conte in order to be more influential in the election of the new President of the Republic in 2022. In this murky scenario, a possible change in the composition of the majority is not implausible and it might imply a new executive with a new PM. For now Conte appears secure, because there is no competitor as a possible “technical” PM on the horizon nor an external shock. However, for example, should he encounter difficulty in implementing the Recovery Fund, both at European and international level, or in case of a sudden economic slowdown, Conte risks becoming the scapegoat for the majority. The legislature seems safe, but the Parliament remains a potential trap. And, under these conditions, two years could be a long time for any Prime Minister.

The future of the right-wing opposition. The regional elections have an impact also on the opposition. The League is still the first party of the coalition, but it is polling over 20% only in the centre-north regions (Tuscany, Marche and Umbria are the last frontier). The 2019 European elections seemed to consolidate the southern expansion of Salvini’s party, but the latest regional elections showed the opposite. The rise of Veneto governor Luca Zaia will probably lead Salvini to reconsider the expansion project in the South, focusing more on representing the interests of the industrial areas of the centre-north. Also in terms of its political programme, the League is now less inclined to use overtly euro-sceptical, and more precisely anti-euro, rhetoric. The approval of the Recovery Fund is realigning the Italian right, which is assuming a more realistic posture. Salvini and Meloni are now focusing on how to spend those European funds, rather than contesting their establishment. Moreover, Meloni is gaining ground in the political debate and in the internal balance of power with Salvini (for these regional elections she was able to choose the coalition candidate in Le Marche and Puglia), while Forza Italia appeared in an irreversible decline, both in the polls and in leadership. There is no worthy substitute for Berlusconi’s charisma on the horizon. Overall, the right-wing opposition appears less moderate than in the past, but at the moment the parties are not steering toward further radicalization.

leggi anche

Pd-M5s, Zingaretti: "Asse con Di Maio? No, finalmente coalizione"

Forecasts

Probability of snap elections:

• Elections within Q2 2021: 10%

• Elections after Q2 2022: 90%

With the approval of the constitutional reform to reduce parliamentary seats, it seems very unlikely there will be a snap election before the “white semester”, the last six months before the election of the new President of the Republic in which it is constitutionally not possible to dissolve Parliament. For this reason we consider likelier a snap election after the appointment of the new Head of the State or a general election at the regular expiration of the legislature in 2023. If the Parliament remains highly factionalized and the government proves particularly weak in managing economic recovery, an early vote after the election of the new President is probable. However, in any case, it will be only a few months before the natural end of the legislature.

In conclusion, we should not forget that a safer legislature does not automatically mean a more stable government or more effective government action. Indeed, at parliamentary level many strategies might be adopted by political parties, both in looking for a change in the composition of government and in pork barrelling new policies. Today, the most likely scenario remains that the Conte 2 government will remain in charge up to 2022 or 2023. However, a change in the majority and the appointment of a new government cannot be excluded and should not be a surprise if they happen. Conte 2’s survival will depend on successful bargaining among parties on the use of European funds and on the capacity of the Prime Minister to pick his way through a wary Parliament.

leggi anche

Manovra da 40 miliardi e assegno unico figli. Dubbi su modello tedesco

Mapping risks

There are three major risks at this moment concerning the Italian political system:

• A difficult balance. With the political strengthening of the PD to the detriment of the Five Star Movement, the balance of power within government might be a risk. Indeed, the Five Star Movement is on the brink of imploding which could lead to a split in the party. This event could use up government time in dealing with the political dynamics (e.g. having to negotiate on every decree and law with smaller and different groups) and it could undermine the effectiveness of the reform efforts (already difficult even before the regional elections). Moreover, this political instability can create more opportunity to open a political crisis and push for a reshuffle or a new executive.

• A slippery parliament. In a majority consisting of numerous fractions, one of the major risks is pork barrelling of the EU funds and the budget law. Every faction within the parties in the coalition will try get as much as possible for its interests and supporters from the budget process, which in the next two years will be particularly delicate owing to implementation of Next Generation EU. A high degree of fragmentation among Five Star Movement factions, Renzi and the PD will not help the design of structural reforms. History can teach us something: the Monti government’s reform plan was largely torpedoed by the then majority and assaulted with pork-barrelling practices. In this phase, the risk for Conte 2 is the same: maintaining the status quo, without any dangers but also without reforms. Moreover, the first year of the government has already shown an inclination toward micro-policies, protecting vested interests of small groups, rather than a grand reform plan.

• The return of the Entrepreneurial State. In the last few months, the government decided to use CDP, the Italian sovereign fund, to become the majority shareholder in Autostrade per l’Italia. The State would take the place of Benetton family to manage the Italian highway network. Was this a wise decision? For the moment, despite the enthusiasm the government and Five Star Movement in particular showed a few months ago, the negotiations are proving to be more difficult than expected for the return of the State, through CDP, as the main shareholder in Autostrade per l’Italia. Meanwhile CDP is also finalizing an agreement to enter Borsa Italiana SPA, today controlled by the London Stock Exchange, in partnership with the French-led consortium Euronext and Intesa Sanpaolo. The current government is pressing CDP to expand its range of action. The fund is now becoming involved in any strategic or politically sensitive sector, promoting a sort of new financial protectionism. However, the operation is not free from risk. The Italian State is heavily indebted and any failures in business management of the newly nationalised companies would be paid for by Italian taxpayers. Moreover, the decision for more direct action by the government in some economic sectors might worry other European countries by contravening competition rules. And it might be perceived by the market as a signal of weakness of Italian private capitalism.

leggi anche

Covid, Conte: "Proporremo proroga stato d'emergenza a 31 gennaio"

Polls

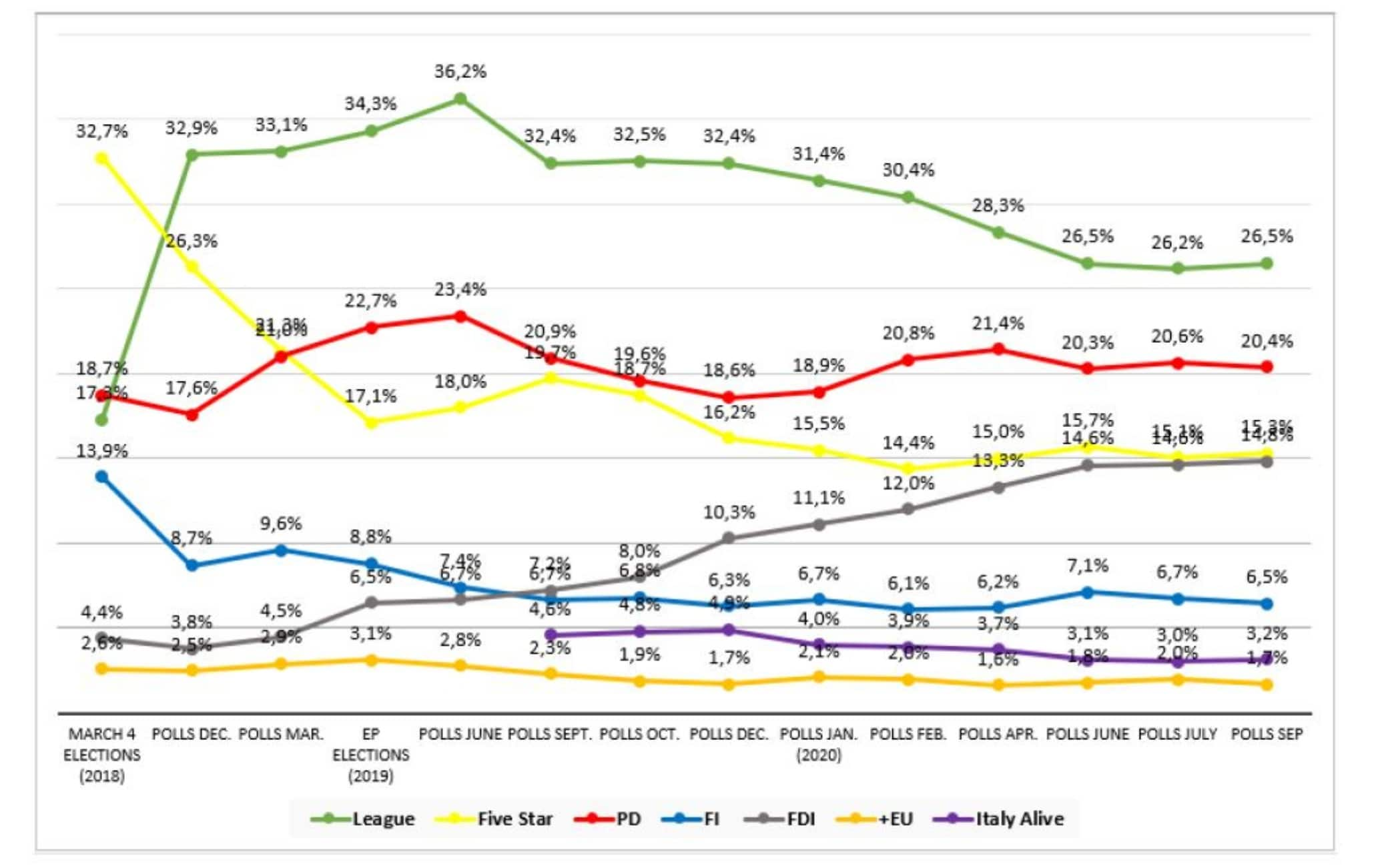

Summer months passed by without any significant change in the Italian electorate. Compared to the polls in July, variations in support for the main Italian parties are minimal and confirm the redefinition of the balance of power between parties (Figure 1). The League is confirmed in the lead, with 26.5% of the votes, but well below the percentage of votes recorded in the European elections one year ago (Salvini's party took 34.3% then). The Democratic Party (PD) follows with 20.4% of the votes, followed by the Five Star Movement (M5S) and Brothers of Italy (FdI) with 15.3% and 14.8% respectively. The performance of Go Italy (FI) is stable at 6.5%, confirming a poor performance that relegates the party to the rear of the centre-right coalition. All the smaller parties that gravitate around the centre-left coalition (Italy Alive, Action, More Europe, and The Left), are below 5%.

approfondimento

Elezioni 2020: l'analisi del voto di YouTrend

Overall, the governing parties (PD, M5S, Italy Alive, and The Left) collect 41.8% of the valid votes. On the other hand, the centre-right coalition (the League, FdI, and FI) reaches 47.8% overall. Although the picture derived from the polls shows the pre-eminence of the centre-right coalition, data should be read in relation to their internal composition and put in the context of the political events that have occurred in the last few weeks (in particular the regional elections of 20-21 September).

Starting from the internal composition of the electoral strength of both governing parties and centre-right parties, the most interesting aspects concern the asymmetries between parties within the two blocs. Among governing parties, the PD is in the lead. The party led by Zingaretti endures both at the national and local level (as emerged from the good results obtained in the regional elections). On the other hand, the M5S is struggling to keep its electorate. The party, compared to the 2018 elections, has more than halved the percentage of its votes. A serious identity and organizational crisis, combined with poor electoral results, a fragile leadership, and internal fragmentation, make the M5S the weakest actor in the ruling coalition. Any structural alliance between the PD and the M5S, then, would see the PD in a decidedly pre-eminent position.

The dynamics within the centre-right mirror this. The League, until now the undisputed pivot of the coalition, seems to have fallen into serious difficulty. First of all, Matteo Salvini's centre-right leadership is no longer unchallenged within the coalition. Giorgia Meloni, leader of FdI, has led the party from 4.4% of the votes in the general elections of 2018, to almost 15% at the national level today (basically the same electoral performance as the M5S). And all this happened thanks to the ability of the party to mobilize centre-right voters who before voted for the League (a dynamic already documented in our previous reports). In other words, while any possible alliance including the M5S in the centre-left could be structured only around the leadership of the PD, in the centre-right coalition, Salvini's leadership may no longer be so sure.

These trends became even more apparent after last week's regional elections. And here we come to a second interesting element which allows us to interpret the survey data presented above. First of all, the data do not (yet) capture a possible effect of the electoral round (the referendum on the reduction in the number of parliamentarians and the regional elections) on individual voting intentions. And, given the importance in public debates of both the constitutional referendum and the regional elections, it is plausible to expect that the outcome of the vote will produce an effect on voter orientations. To evaluate them, however, we will have wait.

Secondly, the final result of the regional vote provides some more general insights into Italian politics. Six regions1 (Veneto, Liguria, Tuscany, Marche, Campania, Puglia) went to the polls on 20-21 September. Before the consultation, 4 of these regions (Tuscany, Marche, Campania, Puglia) were administered by the centre-left (i.e. the PD or coalitions supported by the PD) and 2 instead (Veneto and Liguria) by the centre-right. Contrary to predictions, which suggested a complete reversal in the balance of power between the centre-left and centre-right, the final result was 3-3. The centre-right managed to snatch only Marche from the centre-left (while winning Veneto and Liguria, where the centre-right incumbents were re-elected). True, the result in Marche was a shock for the region, which has always been administered by centre-left governments. It is worth noting, however, that in this case the presidential candidate was from FdI and not the League. Most importantly, the centre-right failed to win Tuscany and Puglia (regions whose electoral results were considered uncertain on the eve of the vote and where in the end the centre-left incumbents were largely reconfirmed).

In other words, the result of the regional elections seems to show two important things: first, the electoral expansion of the centre-right under the leadership of Matteo Salvini is no longer unstoppable; second, the centre-left (and the PD in particular) is still able to mobilize large numbers of voters and, in some areas of the country, to resist the incursions of the centre-right

.

Finally, it is worth noting the poor performance of the M5S and its implications at the national level. On the one hand, the M5S claimed the large success of the Yes vote (in favour of the reduction in the number of parliamentarians) to be a success for the Movement. On the other hand, this success failed to hide the deep troubles of the M5S. It is true that the Movement founded by Grillo has never obtained good results in local races; however, today it seems it has completely disappeared from some local areas. It is no coincidence that the leaders of the Movement are today looking for a way to restructure and reorganize the party. And the equilibria within the national governing majority could depend on this process of renovation. The weakness of the Movement, combined with the electoral resistance of the PD both locally (see the regional elections) and nationally (see the polls), could in fact shift the centre of gravity of the government much more to the left than in recent months.

Economic Scenario

During the second quarter of 2020 GDP decreased by 12.8% compared to the previous quarter, while it went down by 17.7% compared to the previous year. Nevertheless, the last data on the Italian economy suggests that in the third quarter GDP will bounce back to +9%, with the overall annual economic activity forecasted to be in the range of -10 and -11 percent. Starting from May and until the latest data available (July), the Italian economy has been characterised by diffused signal of recovery for the industrial production, manufacturing new orders and external trade, with exports that increased both in EU and extra EU markets. In August business confidence confirmed its strong upward trend started in June, that is now diffused to all sectors although with various intensity, whereas consumer confidence timidly improved, suggesting sluggish private consumption for the rest of the year. In August the Italian economy registered the fourth consecutive month in deflation, nevertheless deflationary pressures from June are driven by dynamics in oil prices, amplified by the appreciation of the euro. In the Eurozone, economic indicators show positive signals after the deep recession in the second quarter of 2020 (-11.8%), with an expected rebound projected to 8.4% in the third quarter. As for Italy, also in the euro area inflation is influenced by the considerable drop in oil prices, the appreciation of the euro and the temporary reduction in the VAT rate in Germany. Hence, the headline HICP inflation will be stable around zero for the coming months. In the medium-term inflation is projected to rise due to a recover in oil prices and also to a stronger demand, together with diminishing upward pressures from adverse supply effects linked to the pandemic.

For the first year of implementation of the key recovery instrument of the Next-Generation EU, the Recovery and Resilience Facility (RRF), the European Commission (EC) has proposed frontloaded financial supports of €672.5 billion, of which €312.5 billion in grants and €360 billion in loans. In order for the Facility to be fully operative as of 1 January 2021, the EC calls on the European Parliament and the Council to agree as quickly as possible on the legislative proposal. Under the temporary recovery facility, the funding will be made available in accordance to National Recovery Plans (NRP), a document in which Member States must provide the estimated costs for reforms and investments in line with the EU policy agenda (environmental sustainability, productivity, fairness and macroeconomic stability) and with flagship areas highlighted by the EC (power up, renovate, recharge and refuel, connect, modernise, scale-up, reskill and upskill). The deadline for submission of the Recovery and Resilience plan is 30 April 2021. However, the EC strongly encourage to start submitting their preliminary drafts from 15 October 2020, as to allow a broad policy dialogue as soon as possible and avoid last-minute arrangements. The NRP will then be assessed by the EC and then approved by the Council by means of an implementing decision following a proposal from the Commission.

On August 16, the EC has created the Recovery and Resilience Task Force, within the EC’s Secreteriat-General, to give support to Member States for the coordination and the implementation of the Recovery and Resilience Plan, the bulk of the funding from the Next-Generation EU. The task force, under Commission President von der Leyen authority, in addition to support Member States with the elaboration of their Recovery and Resilience plans, ensure that plans comply with regulatory requirements and with the green and digital transition objectives, as well as to monitor the implementation of financial supports and coordinate the European Semester in this period of time. The allocation of the €672.5 billion RRF fund follows a well-defined approach. Loans can be requested by Member States up to a maximum of 6.8% of its Gross National Income, even though exceptional circumstances can allow Member States to require additional loans. Grants are allocated following two methodologies. 70% of the total €312.5 billion made available in grants are allocated taking into account the Member State’s population, the inverse of its GDP per capita, and its average unemployment rate over the past 5 years (2015-2019), always in comparison with EU averages. For the remaining 30%, the unemployment rate will be replaced by the observed loss in real GDP over 2020 and the observed cumulated loss in real GDP over the period 2020-2021. Italy is set to receive the largest share of the fund, slightly more than 28%, that amounts to €209 billion, of which €81 billion as grants and €127 billion as loans.

Member States can begin to receive disbursements after the new legislation enters into force, which is expected to be from the beginning of the next year, subject to a positive assessment of their plans by the EC and the subsequent approval of the Council. In exceptional circumstances where one or more Member State considers that there are serious deviations from the satisfactory fulfilment of the relevant milestones and targets of another Member State, they may request that the President of the European Council refer the matter to the next European Council meeting. In that case the EC will suspend all or part of the financial contribution to that Member State. It is therefore crucial to present a national Recovery and Resilience plan with substantive reforms and investments in line with national challenges. There is too much at stake to miss this unprecedent opportunity.

%20(1).jpg?im=Resize,width=375)

)

)

)

)

)