Il report mensile della School of Government della Luiss. Le scelte politiche dell'autunno condizionate dall'effetto Covid

Italian politics has always been an arcane subject. A handful of specialists and enthusiasts love to talk of its Machiavellian intricacies for hours on end, but most people, especially north of the Alps, not only do not understand it, but see no reason why they should bother to understand it. Today there are at least three reasons why they should. First, in Italy the crisis of the political establishment that is now evident in many advanced democracies began a quarter century ago. This means that the country is further down the road of the democratic malaise – it is a laboratory and a bellwether. Second, Italy is the first country from within the historical core of the European community to be governed by anti-establishment parties. Third, its politics represent the greatest threat to the stability, or possibly even the existence, of the common European currency.

Founded in 2010 in a University that has a very strong international vocation, the Luiss School of Government aims to facilitate the connection between Italy and the world outside of it. It aims to prepare the future Italian public elite for the complexities of an ever more integrated planet, and to provide first-class education to non-Italian students in Italy’s capital city. SoG professors have often helped non-Italian journalists and newspaper readers understand Italian politics. Thus, it seems only natural to me that the Luiss SoG should offer a monthly report on Italy that provides an interpretation of the country’s recent political events, and makes an educated guess about what happens next.

1. Scenario and risks

1.1. Politics

The second wave of the pandemic. The Conte government is facing another delicate moment of the pandemic. In many ways, the second wave of the virus is more problematic than last spring's. On a political level, the polls reveal a growing mistrust of the government and the figure of the Prime Minister. During the first lockdown, the Prime Minister’s office, Palazzo Chigi, had skilfully exploited the sudden emergency, thanks to effective and centralized communication. Today such management appears more difficult owing to the problem of addressing the healthcare issue without ignoring the economic and social concerns. Furthermore, on an administrative level, all the historical weaknesses of the Italian State have been highlighted: an inefficient chain of command, supply difficulties, organizational and personnel shortages. It is also more complex to cope with the economic emergency, with retailers and micro- entrepreneurs increasingly concerned about their future in the face of opening time restrictions and closures due to the lockdown. Social protests, from a range of origins, in the biggest Italian cities have also increased the executive's uneasiness. Finally, there is the territorial aspect, that is the continuous tug-of-war between central and local power on lockdowns and on healthcare organization which highlights the dysfunctionality of Title V of the Constitution and increases suspicion and mutual distrust between the regions and the central government. In favour of the executive, however, is the split in the opposition. The fierce competition between the League and the Brothers of Italy for control of the same electorate and the distance marked in recent days by Berlusconi with the sovereigntist movement make the minority less effective in Parliament and in the public debate. If a parliamentary crisis occurs in coming months, Forza Italia would almost certainly be part of the game to form a new government, even with those who are political opponents today. This is less likely to happen for the two right-wing parties.

1.2. Scenario

The Five Star Movement’s Estates General: more of the same? The Five Star Movement held its virtual congress this month. The result is the status quo: there was no break-up of the party triggered by Alessandro Di Battista, the leader of the radical populist faction, nor was there the emergence of new leadership. For the moment, the Movement is still in the hands of the former head of the party Di Maio, the President of the Chamber of Deputies Roberto Fico and the ministers in the Conte 2 Government. The oligarchy of the first wave of parliamentarians (2013- 2018) still rules the Movement. Beppe Grillo did not participate, while Prime Minister Conte sent only a message of greetings in which he defended his government. The Five Star Movement is now much more similar to a traditional party than in the past, with a central committee to overview its political orientation. However, in a parliamentary system dominated by parties such as Italy’s, this might not be good news for Conte. Indeed, the Prime Minister has progressively become more detached from the party leadership. He is governing as an institutional actor and not as a political leader. In this scenario, he is dependent on the powerbrokers of the parties who in the future might decide to sacrifice the Prime Minister to form a new government. Today there is still no such political trigger, but in an emergency scenario rapid changes cannot be excluded in the next few months. In terms of the calendar, it is worth keeping an eye on next spring, when the next administrative elections take place. Indeed, it seems likely today that a more structured alliance with the centre-left might be in the future of the Five Star Movement. In that case, internal tension could rise.

ESM dropped. In recent months there was a lot of discussion within the majority on the eventual use of funds from the European Stability Mechanism. The PD supported this option, but the Five Star Movement opposed ESM financing, arguing that the financial and economic constraints imposed by ESM rules on the Italian budget in the following years would have been too tight. But in recent days the discussion fell away because some major personalities in the PD, such as the President of the European Parliament David Sassoli and the former Prime Minister Enrico Letta, proposed moving the ESM funds into the EIB, using them as ordinary loans for the industrial sector. If this happens, the ESM bomb will be defused. In political terms, this might increase the possibility of rapprochement between the governing majority and the opposition which strongly opposed the use of the ESM too. The major division in Italian politics of recent years, the relationship with the EU, is reducing. In the case of a worsening in economic and sanitary conditions and delay in supply of the Recovery Fund, some form of cooperation between political forces will become more probable.

A divided opposition. The right-wing coalition is having trouble finding a common political strategy to tackle the pandemic. The alliance governs fifteen Italian regions out of twenty and the leaders, particularly Salvini and Meloni, are in the hands of their regional presidents. Moreover, Silvio Berlusconi is offering “soft” opposition and has opened up to possible cooperation at parliamentary level with the majority. For these reasons, the political strategy of Salvini and Meloni seems incoherent: sometimes arguing for stronger lockdown measures and sometimes for a loosening in order to save small businesses. The division between Forza Italia and the two right-wing parties is a sign of weakness. The League is declining in the polls, while Brothers of Italy has grown to over 15%. As a result of this rebalance, there is no secure leadership in the right-wing coalition. This disunity is an advantage for Conte that might tempt Berlusconi to offer him a new centrist political position and to protect his family business through legislation. Indeed, the Mediaset Group might be considered, by a law under discussion in Parliament, as strategic and protected against being acquired by a foreign company. It seems likely that the media tycoon will remain in the middle, not directly joining the government nor strongly opposing Salvini and Meloni. Forza Italia might help the executive in Parliament, particularly when it needs their votes.

1.3. Forecasts

Probability of snap elections:

Elections within Q2 2021: 10%

- Elections after Q2 2022: 90%

At parliamentary level many strategies might be adopted by political parties, both in seeking a change in the composition of government and in pork barrelling new policies. Today, the most likely scenario remains that the Conte 2 government will remain in charge up to 2022 or 2023. However, a change in the majority and the appointment of a new government cannot be excluded and should not be a surprise if it happens. Conte 2’s survival will depend on successful bargaining among parties on the use of European funds and on the capacity of the Prime Minister to pick his way through a wary Parliament.

There are two alternative scenarios for Conte 2’s survival: the first is, given a wider economic and healthcare crisis, the creation of a national unity government in which the opposition joins the majority. In this case, it seems very likely that Conte would not survive as Prime Minister. A more neutral figure might arrive in Palazzo Chigi in this case. The opposition governs fifteen regions out of twenty, as a consequence even now the League, Brothers of Italy and Forza Italia are forced to partially cooperate with the executive on managing the pandemic. A convergence is not implausible, especially if we consider that European integration is now a much less disputed issue.

The second scenario is the widening of the current majority to Berlusconi’s Forza Italia. The former Prime Minister has shown willingness to cooperate with the government on healthcare and European funds for the economic recovery. In this case, Conte would remain in charge and he could rely on Forza Italia in the case of defections on the Five Stars side. Berlusconi would gain more say in politics, he could have more protection of his family business interests and Forza Italia could obtain the approval of its policy proposals. Moreover, this solution might be used by Berlusconi to distinguish himself from the right-wing politics of Salvini and Meloni, thus preserving his centrist electorate.

Currently, we consider the survival of the Conte 2 Government the most likely scenario (60%). Then, there is some chance of the involvement of Forza Italia (25%), while the creation of a national unity government seems premature at this stage (15%). However, the two alternative scenarios cannot be dismissed as impossible.

1.4. Mapping risks

There are three major risks at this moment concerning the Italian political system:

- A profound economic and entrepreneurial crisis. The possibility of new lockdowns, even selective ones, puts the survival of self-employed workers and micro-enterprises at great risk. According to Censis, 460,000 companies could close or go bankrupt. Cerved estimates an 11% drop in revenues, with even more pessimistic forecasts if the epidemic worsens further. For most analysts, one to two million jobs are at risk - an economic and social catastrophe that could jeopardize the country's financial and political stability in the coming year.

- Administrative bankruptcy. In the coming months, the Italian state will have to try to reorganize itself at all levels to face the pandemic and lockdowns, provide adequate public services, stop the economic crisis, and distribute vaccines. The months between May and October have already seen important administrative failures on these fronts. If the shortcomings were to continue, protests, uncertainty, overcrowded hospitals, and deaths would have a political impact that can no longer be ignored. A more serious emergency than the current one would probably not be tolerated by political forces and institutions. At that point a political crisis in Parliament could become a reality, particularly if a new national lockdown were to come into force.

- Growing fractures. Two fault lines can be identified: one is between the “protected” categories, who pay a very small price for the lockdown on an economic level, and the “unprotected” categories forced to face closures and sacrifice. The anger could soon turn into protest and open the "political market" to new players or to a drive for change. Another fault line is between local governments and the central government, with the growing popularity of regional Presidents at the expense of national leaders. Two thirds of the regions are now in the hands of the opposition or strong and independent PD governors (Emiliano, De Luca, Bonaccini). This scenario can complicate the life of the government, forced to come to terms with the territories and likely to be accused of reneging on its responsibilities to those territories. The historical data on the confidence of the Italian electorate in political institutions shows the tendency to distrust parliament and central government more than local authorities. Moreover, the resolution of the economic crisis, and the risks associated with it, is entirely in the hands of the executive. The risk that in coming months Conte will become a scapegoat remains real. Efficient functioning of the State and political stability are not guaranteed.

2. Polls

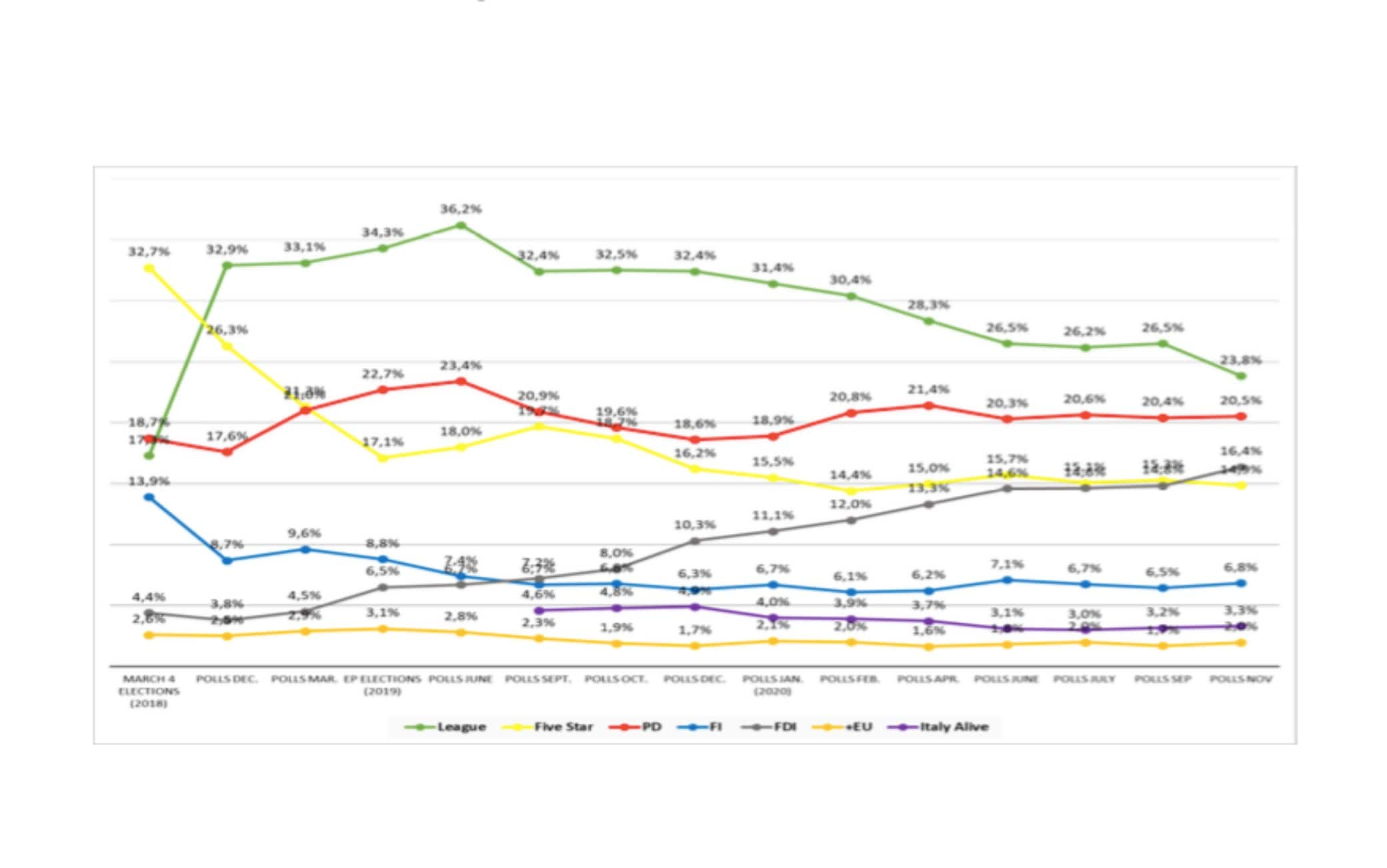

After a period of stability during the summer, the electoral performance of the League has declined again (Figure 1). Matteo Salvini's party today stands at around 23.8%, a drop of almost three percentage points compared to the end of September. Just over a year after the 2019 European elections, the party has squandered an electoral advantage that seemed unbridgeable at the time, losing more than ten percentage points. Although the League remains the first party in Italy today, its electoral primacy is seriously challenged. The main centre-left party, the Democratic Party (PD), has 20.5% of the votes, with a gap of just over three percentage points from the League.

If the electoral decline of the League is now a matter of fact, the rise of Brothers of Italy (FdI) is equally apparent (a trend already outlined in previous reports). The party led by Giorgia Meloni is still on the rise and now it polls around 16.4%. This huge growth in the polls signals the restructuring of the balance of power both within the Italian party system and within the centre- right camp.

First, we may note FdI overtaking the Five Star Movement (M5S), something which has remained stable over time and has been polling around 14% and 15% for months now. Second, it is worth noting the narrowing gap between FdI and the Democratic Party: in the European elections in 2019, the distance between the two parties was 16.2 percentage points; today the gap has narrowed to just 4.1 percentage points. The party can thus definitely be considered a major player in Italian politics in all respects. Finally, and from a different perspective, the growing competitiveness of FdI has the potential to rearrange the power relations within the centre- right coalition. With Forza Italia (FI) polling around 6.8% and by now reduced to being a minor player in the coalition, and with the gap between the League and FdI down to 7.4 percentage points, the leadership of the centre-right is once again up for grabs.

Matteo Salvini, the undisputed leader of the centre-right until a few months ago, has to face two challenges to his leadership, one from within his own party; and the other from an external front that is steadily gaining in the polls. On the former aspect (i.e. internally), it is worth noting the emergence within the party of new personalities who might be tempted to take over the party and dislodge Salvini. Among these, Luca Zaia holds pride of place. Re-elected to the presidency of Veneto with 76.8% of the votes in the last regional elections in September, Zaia has been able to present himself as a credible administrator, in particular in his management of the first wave of the Covid pandemic. Furthermore, he is highly appreciated even outside his region and, should he decide to challenge Salvini’s leadership, there would be many Northern League voters (especially among the old electoral base of the party) ready to follow him. Externally, , instead, the rapid growth of FdI puts Giorgia Meloni now in the position to redefine roles and positions within the coalition.

Moving to the parties in government, the main pivotal actor remains the Democratic Party. Under the leadership of Zingaretti, the PD has maintained unity and internal cohesion. Moreover, the party has been able to hold on to a large share of its the electorate. The M5S, although stable in the polls, is instead experiencing a real identity crisis. On the one hand, the more turbulent faction of the Movement, headed by Alessandro Di Battista, is pushing for a return to its origins which excludes any possibility of a structural alliance with the centre-left; on the other, the more moderate and pro-government area supports the idea of a more stable alliance with the PD. It is clear that these internal fractures are symptomatic of a weakness that could also lead to a shattering of the Movement.

Despite the doubts about the future of the M5S, one thing is certain: if the more turbulent area of the party prevails, the possibility of a strong coalition able to compete on a par with the centre-right coalition would disappear. The united centre-right (League, FdI, FI) today stands at 47% in the polls, a slightly lower percentage than at the end of September (47.8%). The parties currently in government (PD, M5S, Italy Alive, and The Left), taken together, reach 41.9% of the votes (with no real difference compared to the end of September, when the governing coalition polled 41.8%). In the span of almost two months, the distance between the two blocks has been reduced by just 0.2 percentage points. The exit of the Movement from the government pact or the exclusion of any possible structural alliance with the PD would pave the way for the electoral success of the united centre-right.

Figure 1- Electoral trends in recent polls

3. Economic Scenario

During the third quarter of 2020 GDP grew by 16.1% compared to the previous quarter, whereas it decreased by 4.7% compared to the same quarter of the previous year. The rebound in growth for the third quarter was in line with those of its main European partners and was fuelled by fiscal policy interventions both at the national and at the EU level. In October, the rate of change in the Italian consumer price index improved from -0.6% in September to 0.2% on monthly basis, while it improved but remained negative from -0.5% in September to - 0.3% on annual basis. For the current year the EU Commission, in its Autumn 2020 Economic Forecast, sees real GDP for Italy to contract by 9.9 percentage points, with an expected recovery of 4.1% and 2.8% in 2021 and 2022 respectively, whereas inflation is to settle at -0.1% for the current year with a recovery in subsequent years, 2021 (0.7%) and 2022 (1.0%).

In September, after four months of robust growth, the industrial production index recorded a drop of 5.6% compared to the previous month, and a similar decline (5.1%) with respect to September 2019. Industrial production grew by more than expected in August (7.7%), outperforming other major eurozone economies. This was largely due to the output, mainly of durable goods, that many companies missed out on in the spring during the coronavirus lockdown and which thus regained some lost ground. However, September data, which reflected downturns in the manufacturing, mining and quarrying and utilities sectors, signalled a weaker level of confidence among firms with regards to activity over the coming year, amid concerns surrounding the COVID-19 pandemic. However, in October the confidence index for the manufacturing and the construction sectors, together with the retail trade, improved, with a decline only in market services. Unlike the manufacturing sector, in October the consumer confidence index saw a surge in uncertainty, with drops in all the components, but mainly driven by economic and future items. This data, highlighting fear of new stringent social measures to contain the spread of the virus, is having an impact on spending decisions, with higher precautionary savings to face the worsening of the healthcare crisis and the likelihood of a second lockdown.

With the Update to the Economic and Financial Document introduced at the beginning of October, the government presented a more optimistic macroeconomic scenario compared to the EU Commission, with real GDP growth forecast to contract by 9% for 2020 and a strong but temporary rebound of 6% for 2021. Inflation is forecast to increase, reaching 0.8%, 1.3% and 1.2% in 2021, 2022, and 2023, respectively. Fiscal policy is expected to remain expansionary in the years to come, with the current budget deficit settling at 10.8% of GDP at the end of 2020, and gradually going down to 7% in 2021, reaching pre-crisis levels not prior to 2025. The ratio of public debt to GDP rose by over 23 percentage points in 2020, to 158%, and, given the expected boost in growth in the following years, and hence better trends in revenues comparedto expenditures,thepublicdebt-to-GDPratioisprojectedtoreach151.5%in2023. On October 18, the Cabinet announced approval of the 2021 draft budget bill. A month later, on November 16, the text of the budget law was finally approved and is now expected shortly in Parliament in order to obtain final approval by the end of the year. The manoeuvre, in allocating over €38 billion, primarily concerns taxation, labour, healthcare, and emergencies linked to the pandemic.

The role of European institutions is now more important than ever for financing COVID-19 policy responses among European countries. In Italy, the financing of the budget deficit for 2020 and 2021 strongly relies on EU programmes (Next-Generation EU and SURE) but mainly on the ECB (through the Bank of Italy). For the current year, the Observatory on the Italian Public Accounts has estimated financing needs of €494 billion, of which €316billion in maturing government bonds and €178 billion in deficit. The ECB and SURE should account for €225 and €27 billion, respectively, with the rest coming from market investors. For the next year, the estimated financial needs amount to €495 billion, of which €372 billion in maturing government bonds and €123 billion in deficit. The Government, in the Update to the Economic and Financial Document, has indicated to use only €25 billion from the Next Generation EU, whereas the amount attributable to the ECB will depend on monetary policy decisions based on future inflation dynamics. Nevertheless, late in September ECB President Christine Lagarde announced that the ECB will consider following the lead of the US Federal Reserve by committing to let inflation overshoot its target after a period of sluggish price growth. This announcement, together with inflation in the eurozone forecast at 1.1% for the next year, indicates that monetary policy will remain fairly accommodative. Hence, net purchases under the pandemic emergency purchase programme will be extended for the whole of 2021. Overall, we should not expect problems in financing conditions for the Italian government over the course of the next year.

On November 10, the European Parliament and EU Member States in the Council reached agreement on the largest package ever financed through the EU budget of €1.8 trillion – €1.1 trillion for the next long-term budget and €750 billion for the Next-Generation EU. Compared to the 21 July agreement at the European Council, the latest agreement has reinforced key programmes, such as Horizon Europe, Erasmus+ and EU4Health, by a total of €15 billion. More than 50% of the EU funds will support modernisation through policies that include research and innovation, environment and digitalisation, recovery and resilience plans and a new health programme, whereas 30% will be spent to fight climate change. Despite that, on 16 November, Hungary and Poland vetoed the adoption of the next long-term budget and the Next-Generation EU. The veto did not reflect concerns on the substance of the agreement but was directed against a clause which makes the access to funds conditional on respecting the rule of law. The two governments are against linking EU funds to the respect for the rule of law because they are under a formal EU process investigation for undermining the independence of courts, media and non-governmental organisations. As a result, EU Ambassadors could not reach the necessary unanimity to initiate the written procedure due to reservations expressed by the two Member States. After the EU Council vote, euro area ministers urged Poland and Hungary to drop their veto over the union’s long-awaited budget deal. Negotiations are not over yet.

)

)

)

)

)